VCs Investing in Franchising

Here are the VCs we know who are excited about investing in franchise businesses.

1: Yoni Rechtman from Slow Ventures

Slow view franchising as an alternative to vertical SAAS that allows the startup franchisor to capture a larger slice of the value their innovation creates. Instead of building software and spending VC money of acquiring small businesses as customers, why not build a better small business with your software and scale efficiently as a franchise? They are interested in investing in seed rounds where a majority of the capital raise is to be spent in acquiring franchisees. Yoni and team published a deck detailing their thesis here.

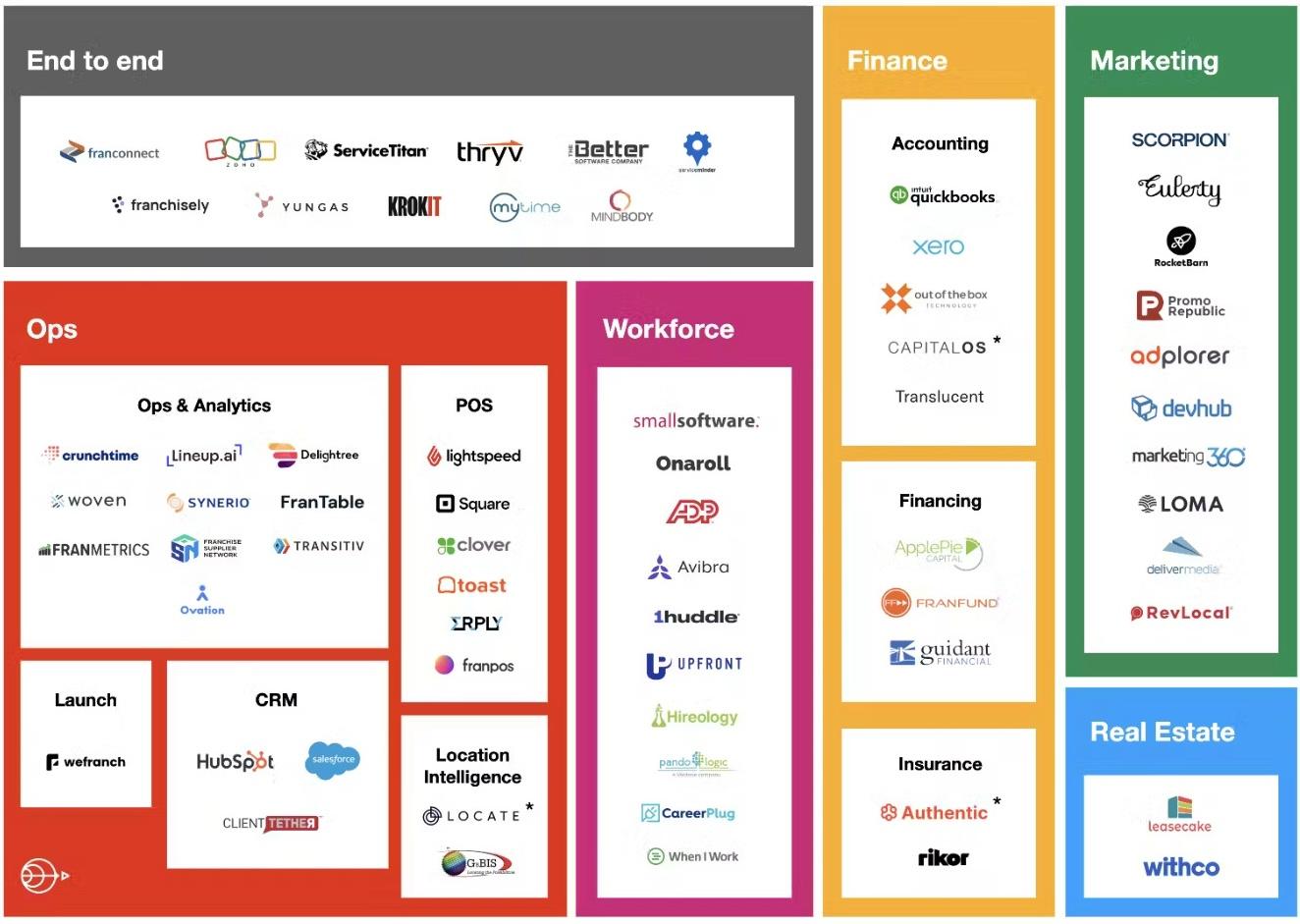

Yoni gives an intro speech and explanation of franchising at the NY #TechWeek Franchise Pitches event

Yoni at Wefranch x Slow VC Franchise Pitches Event

Yoni at Wefranch x Slow VC Franchise Pitches Event2: Paul Strachman at SPAR Ventures

Paul is primarily interested in investing in startups that are bringing technology to the SMB space as he feels they are underserved. He worked at Equinox, one of the leading service brands, for many years, so he has an intimate knowledge into the challenges and value of excellent operations. SPAR Ventures invests in early stage tech-enabled B2B companies serving the SMB market.

3: Sonya Brown at Norwest Venture Partners

Sonya has been advocating for the franchise business model for the past eight years . Norwest recently invested in Poolwerx, an Australian concept moving into the US. They have also invested in Junk King and The Learning Experience . Norwest views franchising as a vehicle to rapidly scale a brand. They are specifically interested in home service franchise concepts at the moment.

4: Brian O’Malley at Forerunner Ventures

Forerunner are primarily interested in digitally native franchises. They have been savvy about picking founders who built great brands online. They see franchising as the next step in monetizing these brands to deliver services not just goods. Brian explains Forerunner’s thesis on digitally native franchises in this post.

Jason Bornstein talking about digitally native franchises at the Blitzscale your brick and mortar into a Franchise Empire event.

Jason Bornstein at the Wefranch event

Jason Bornstein at the Wefranch event5: Isabelle Phelps at Lerer Hippeau

Isabelle has taken an interest in franchise businesses. Lerer Hippeau led the Series A in HeyDay , a skincare franchise. They also invested in Everytable who is innovating in the social equity franchise space. Lerer Hippeau views franchising as a capital efficient way to scale experiential retail startups.

6: Yousif Al-Dujaili at Levante

Franchising is one of the four themes Levante focuses on. Yousif previously worked at Cat Rock who were investors in Dominos and there he saw how powerful franchising is for building high margin scalable businesses in unglamorous industries. Levante is looking for startups that can use software as an edge in building a breakout franchise business.

7: Rex Woodbury at Daybreak Ventures

Daybreak is an early-stage venture firm built for the next generation.

Rex authored “Business-in-a-Box 2.0” where he talks about the new wave of businesses that are easier to start and manage due to tech enablement.

Excerpt from Business in a Box by Rex Woodbury

Excerpt from Business in a Box by Rex Woodbury8: Jerry Lu at Maveron

Maveron was founded by Howard Schultz, the former CEO of Starbucks. Maveron’s interest in franhsise stems from their focus in consumer businesses. This is somewhat ironic considering Starbucks is one of the most successful food and beverage businesses that generally does not offer franchise opportunities domestically. Starbucks did bring on Magic Johnson as a franchisee in their successful urban opportunities venture. Jerry is interested in franchise businesses that can transform the consumer experience.

Magic Johnson, the first Starbucks franchisee in the US, & Howard Schultz, the founder of Maveron Ventures

Magic Johnson, the first Starbucks franchisee in the US, & Howard Schultz, the founder of Maveron Ventures9: Arif Damji at Conductive Ventures

Conductive is a $450 million fund primarily interested in franchises for the capital efficiency of the model. Arif also has personal experience withe the franchise industry through franchises in his immediate family.

10: Andrew Chen at A16Z

SandboxVR is the franchise startup that has raised over $119M. Andrew, their deal partner, is interested in franchising as it ties closely to gaming. E-Sports startups like Contender E-Sports and XP League scale through franchising and are natural fit for the A16Z Games Fund. Traditional Sports leagues like USL Super League and USL League One also franchise and are natural fit for the A16z Cultural Leadership Fund who led a celebrity party round in Sandbox VR .

Sandbox VR

Sandbox VRVCs x Franchising Reading List:

From Digitally Native Brand to Digitally Native Franchise: a New Model for Commerce and Entrepreneurial Empowerment: an article about Forerunner’s unique take on digitally native franchises.

Why Ventures should care about Franchising: a deck explaining Slow’s excitement about the franchise space, and its particular relevancy right now.m

Business-in-a-Box 2.0: a post outlines reasons for the return of the “business in a box”

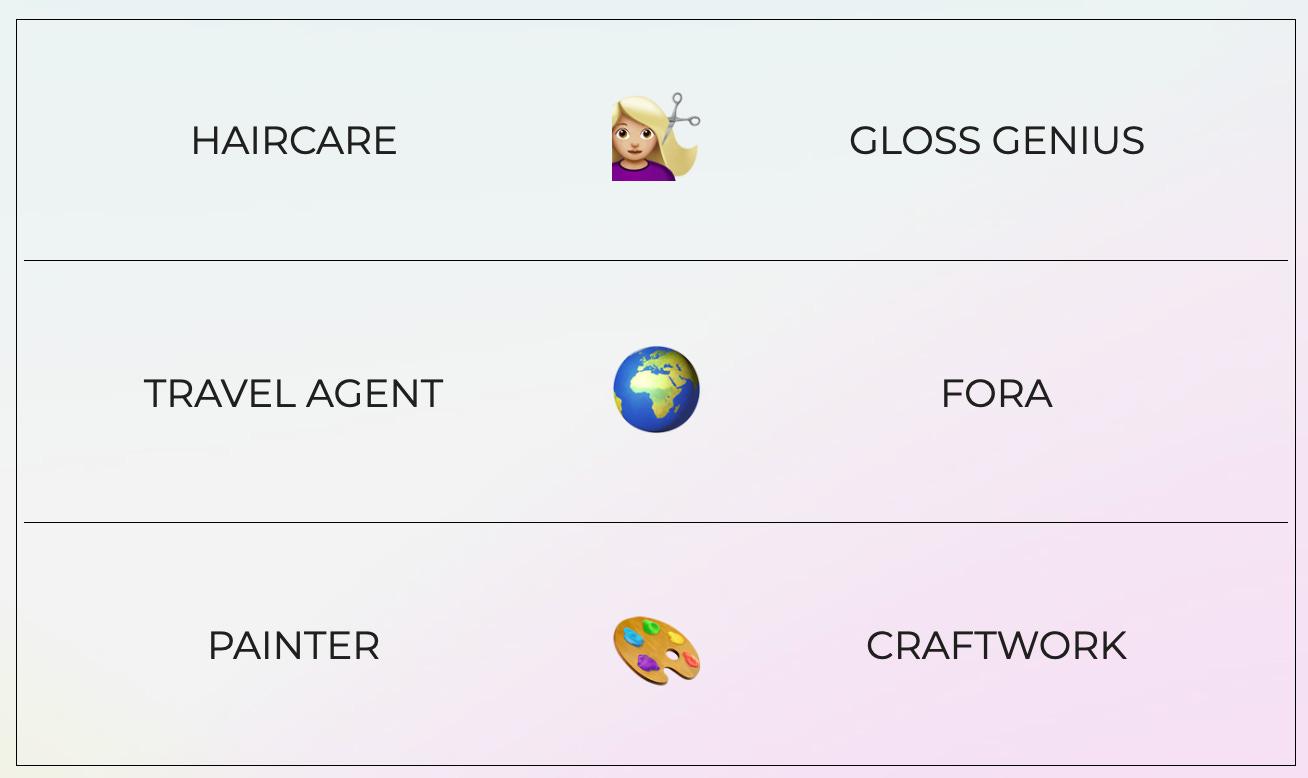

Slow Ventures’ Market Map of Franchising Tools

Slow Ventures’ Market Map of Franchising ToolsEmail us at mariyami@wefranch.com for suggestions and comments.

Did you enjoy reading this blog post?

Sign up and get the data!

or Sign up with an e-mail